SEND MONEY TO INDIA FROM SINGAPORE READILY WITH SPEED REMIT

Transferring money from Singapore to India has never been laid back. Speed Remit assists seamless money transfers with sensible exchange rates for everyone sending money to India from Singapore. Our user-friendly platform ensures a hassle-free experience, making us the right choice for Indian expats in Singapore to send remittances to India. With praising our few-step- money-sending procedure, people also admire us for offering the encrypted remittance transfer service.

WE OFFER STANDARD CONVERSATION RATES FOR SENDING MONEY FROM SINGAPORE TO INDIA

Rely Speed Remit offers real-world conversation rates when transferring money from Singapore to India. We focus on transparency and keep our valued customers knowledgeable about the current rates, ensuring a fair and cost-effective money transfer procedure. We aim to offer the right conversation rates, making the transfer of money to India from Singapore both practical and economical.

INCREASE SAVINGS WHILE TRANSFERRING MONEY FROM SINGAPORE TO INDIA

Are you fretful about fluctuating exchange rates? Take a long breath and sign up for our free Speed Remit exchange rate updates. Receive regular alerts on the latest Singaporean Dollar to Indian Rupee conversation rate, underscoring our mission to makemoney transfers to India from Singaporeaffordable for each Indian expatriate in Singapore.

INEXPENSIVE MONEY HANDOVERS TO INDIA WITH SPEED REMIT

Traditional approaches to transferring money to India from Singapore often come with hidden charges and high transaction costs. Don't let unnecessary fees grind down your hard-earned money. Go with Speed Remit, where we ensure sensible charges to transfer money from Singapore to India. We offer hands-on value for the Singaporean Dollar to the Indian Rupee, along with special deals to maximize your returns.

EVADE EXCLUSIVE BANK TRANSFERS WHEN DIRECTING MONEY FROM SINGAPORE TO INDIA

As banks seem useful for transferring remittances to India from Singapore, their operation costs and unworkable exchange rates can affect you. Opt for the sensible money transfer choice with Speed Remit, where we ensure impressive rates and make sure that your receiver in India receives a great amount of your hard-earned money.

EXPEDITE MONEY TRANSFERS TO INDIA FROM SINGAPORE

If you're in a haste to send money to India from Singapore, explore our fastest money transfer methods. While cash transactions seem speedy, they come with different security concerns. Choose options like mobile wallet transfers, providing a blend of speed and safety. Ourcomprehensive remittanceguide assists you in making informed decisions for quick money transfers.

SELECT THE PERFECT MONEY TRANSFER FACILITY TO INDIA FROM SINGAPORE

Selecting the right remittance transfer service to India from Singapore depends on your specific needs. Speed Remit provides expatriates with tools to make the money-sending process hassle-free. Compare Singaporean Dollar to Indian Rupee exchange rates, transfer speed, transaction fees, and more. Opt for the service that aligns with your requirements and makes money transfer economical.

SIMPLE LADDERS TO SEND MONEY TO INDIA FROM SINGAPORE

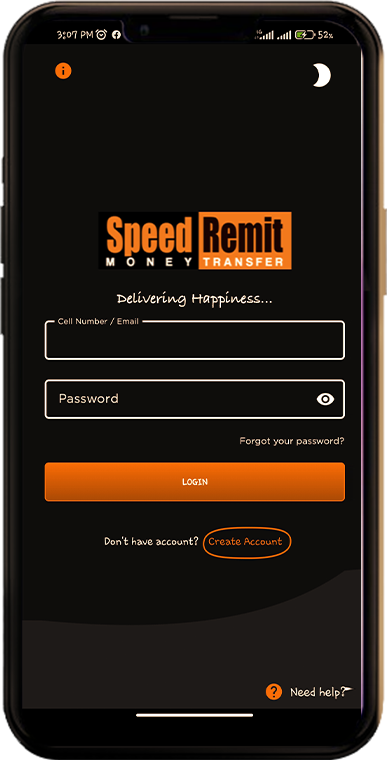

Moving money from Singapore to India is a breeze with Speed Remit. Follow these simple steps:

- Match:Evaluate different providers and their offerings.

- Select:Choose the services that suit your needs.

- Handover:Initiate the transfer process securely.

- Save:Get advantage of other promotions for maximizing savings.

Wrapping It Up

Speed Remit is your answer for worry-free money transfers to India from Singapore, offering competitive conversation tariffs, sensible fees, and quick remittance services. Our platform is approachable across all devices, freeing you from the restraints of using a specific gadget to send money. Look for Speed Remit and get consistent and efficient experience in sending money to India from Singapore.