In today's connected world, the ability to transfer funds globally is crucial for individuals and businesses. Whether you are sending money to family overseas, paying for goods and services, or investing in international markets, understanding the nuances of global fund transfers is essential. For first-timers venturing into this realm, knowing the right path to sending money is a must. Exploring the landscape of international fund transfers requires knowledge, caution, and strategic planning.

It is not just about moving money from one account to another; rather, it involves a complex network of financial institutions, currencies, regulations, and exchange rates. First and foremost, one must be aware of the various methods available for international transfers. Traditional bank wire transfers, while reliable, can be costly and time-consuming. Alternatively, online payment platforms offer convenience and speed, but they may come with varying fees and exchange rates. Additionally, compliance with regulatory requirements cannot be overlooked. Anti-money laundering (AML) and Know Your Customer (KYC) regulations are enforced to prevent illegal financial activities.

1- Exchange Rates and Fees

Understanding exchange rates and associated fees is crucial when transferring funds internationally. Exchange rates fluctuate constantly, impacting the final amount received by the recipient. Additionally, financial institutions often charge fees for currency conversion and transaction processing. It's important to compare rates and fees across different providers to minimize costs.

2- Transfer Methods

Various methods are available for transferring funds globally, including bank transfers, online payment platforms, and remittance services. Each method has its advantages and limitations in terms of speed, cost, and convenience. Consider factors such as transfer speed, reliability, and accessibility when choosing the most suitable method for your needs.

3- Transfer Speed

Transfer speeds vary depending on the selected method & the destination country. While some transfers can be completed within minutes, others may take several business days to process. Factors such as currency availability, intermediary banks, and regulatory requirements can affect transfer times. Plan and choose a method that aligns with your timeline.

4- Regulatory Compliance

Global fund

transfers are subject to various regulations and compliance measures aimed at

preventing fraud, money laundering, and terrorist financing. As a result,

financial institutions may require documentation and information to verify the

legitimacy of transactions. Ensure compliance with regulatory requirements to

avoid delays and complications in the transfer process.

5- Recipient Details

Accurate

recipient details are essential to ensure funds reach the intended recipient

promptly. When initiating a transfer, double-check the recipient's name,

account number, and any other relevant information to minimize the risk of

errors. Providing incorrect or incomplete recipient details can lead to delays

and potential loss of funds.

6- Security Measures

Security is

paramount when transferring funds globally to protect against unauthorized

access and fraud. Choose reputable and secure platforms or financial

institutions with robust encryption and authentication mechanisms. Avoid

sharing sensitive information such as passwords or personal identification

numbers (PINs) through unsecured channels.

7- Transaction Tracking

Many

transfer services offer tracking capabilities that allow senders to monitor the

progress of their transactions in real time. Tracking features provide

transparency and peace of mind by confirming when funds are sent, received, and

credited to the recipient's account. Take advantage of these tracking tools to

stay informed throughout the transfer process.

8- Currency Considerations

Currency

fluctuations can impact the value of transferred funds, affecting both the

sender and recipient. Consider the stability and volatility of currencies

involved in the transfer, as well as any potential exchange rate risks. Hedging

strategies such as forward contracts or currency options may help mitigate

currency risk for large or recurring transfers.

9- Customer Support

Reliable

customer support is essential for resolving issues and addressing concerns

related to global fund transfers. Choose providers that offer accessible

customer service channels, such as phone support, email, or live chat. Prompt

and knowledgeable assistance can help streamline the transfer process and

provide assistance in case of any unexpected challenges.

Why to Acquire Speed Remit’s Service

In the

sphere of international fund transfers, navigating through the myriad of

options can be overwhelming, especially for first-timers. However, amidst the

sea of choices, one beacon of reliability, efficiency, and speed stands out:

Speed Remit. Below are the reasons why first-timers should opt for Speed Remit

to transfer funds internationally

·

Rapid Transactions

Time is of

the essence, especially when it comes to transferring funds across borders.

With Speed Remit, first-timers can bid farewell to long waiting periods

typically associated with traditional bank transfers. Speed Remit's

cutting-edge technology ensures that your money reaches its destination

swiftly, allowing for timely transactions without unnecessary delays.

·

Modest Exchange Rates

Are you

worried about losing a chunk of your hard-earned money to unfavorable exchange

rates? Fret not! Speed Remit offers competitive exchange rates that ensure you

get the most value out of your currency conversion. First-timers can rest

assured that their funds will be transferred at rates that are fair and

transparent, without hidden fees or surcharges.

·

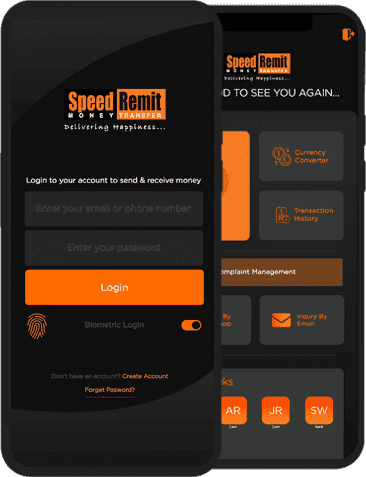

Responsive Interface

Navigating through complex transfer procedures

can be daunting for first-timers. However, Speed Remit simplifies the process

with its intuitive and user-friendly interface. From initiating transfers to

tracking transaction statuses, every step is designed to be seamless and

hassle-free. First-timers can easily navigate through the platform, making

international fund transfers a breeze.

Encrypted Fund Transfer Method

Security is

a must when it comes to financial transactions, particularly in the digital era.

Speed Remit employs state-of-the-art encryption protocols and security measures

to safeguard your funds and personal information. First-timers can have peace

of mind knowing that their transactions are protected against unauthorized

access and fraud.

·

Impressive 24/7 Customer Support

Are you

feeling lost or confused? Speed Remit's dedicated customer support team is

always at your service. Whether you have inquiries about the transfer process

or encounter any issues along the way, help is just a click or call away.

First-timers can rely on prompt and courteous assistance from knowledgeable

professionals, ensuring a smooth and satisfactory experience.

·

Worldwide Reach

Whether you're sending money halfway across the globe or to neighboring countries, Speed Remit offers a vast network of international partners, ensuring coverage in various regions worldwide. First-timers can leverage this extensive network to transfer funds to virtually any destination with ease and convenience.

Wind Up

Initiating

global fund transfers for the first time needs careful consideration of

different factors, including exchange rates, transfer methods, regulatory

compliance, and security measures. By understanding these nine essential

must-knows and taking proactive steps to mitigate risks, first-timers can

confidently initiate and manage international fund transfers with ease.