How Do You Send Money From Australia to Singapore?

Australia is celebrated for its multiculturalism, and the presence of Singaporean immigrants has added a unique and dynamic dimension to its cultural tapestry. The ties between Australia and Singapore run deep in terms of shared histories and through the constant flow of people and ideas. One significant aspect of this connection is the financial support that many Singaporean expatriates in Australia extend to their families and loved ones back in Singapore. Sending money overseas is a regular practice, but it often comes with challenges.

The intricacies of international money transfers can be perplexing, and misinformation can further complicate the process. This guide aims to simplify the complexities of sending money from Australia to Singapore. We'll debunk common myths surrounding international remittances and offer a comprehensive overview of the steps involved. Whether you are a newcomer to the process or looking to optimise your remittance practices, this guide will provide valuable insights.

Must-Knows of Global Fund Transfers

Knowing the

various options for sending money, comparing exchange rates, and navigating

through the regulatory landscape can make a substantial difference in the

efficiency and cost-effectiveness of your transactions. We'll delve into these

aspects and equip you with the knowledge to make informed decisions. Moreover,

we'll explore the technological advancements that have revolutionised the

remittance industry, making it more convenient and accessible. From traditional

bank transfers to modern online platforms and fintech solutions, we'll discuss

the pros and cons of each method. Additionally, we'll address common concerns

such as transaction fees, currency conversion rates, and the time it takes for

the funds to reach their destination.

By providing practical tips and strategies, we aim to empower you with the tools to navigate the intricacies of international money transfers confidently. In essence, this guide seeks to serve as a reliable resource for the Singaporean diaspora in Australia, fostering a better understanding of the remittance process and facilitating smoother financial transactions between these two culturally rich nations.

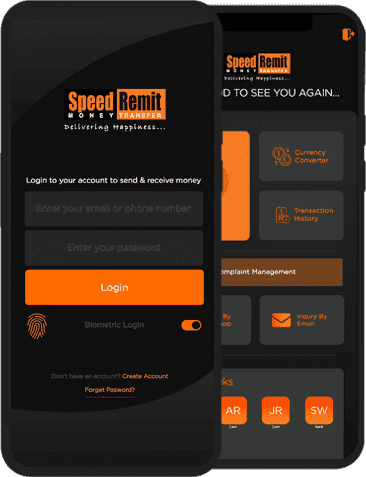

What Makes Speed Remit the Right

Option to Fund Transfers

Speed Remit

is recognised as a highly reliable and trustworthy platform for facilitating

money transfers from Australia to Singapore. With a solid reputation built on

efficiency and security, Speed Remit ensures a seamless and quick process for

sending money across borders. The platform's user-friendly interface makes it

easy for individuals to navigate the transaction process, providing

transparency and clear communication at every step. Speed Remit employs

advanced security measures to safeguard financial transactions, giving users

peace of mind regarding the safety of their funds.

The

company's commitment to competitive exchange rates and low transfer fees

further enhances its appeal as a preferred choice for those seeking a

dependable means of remitting money between Australia and Singapore. Overall,

Speed Remit stands out as a reliable and efficient platform, earning the trust

of users looking for a secure and hassle-free way to send money

internationally.

Segments of Singaporean Immigrants in

Australia:

Students and Expatriates: Many Singaporeans move to Australia

for higher education or employment opportunities. This segment often requires a

seamless and cost-effective method to send money to their families or manage

finances in Singapore.

Permanent Residents: Individuals who have chosen Australia as their new home while maintaining strong ties with family and investments in Singapore.

Myths Linked to Sending Money to

Singapore:

High Transaction Costs: Contrary to popular belief, there

are cost-effective ways to transfer money internationally. Understanding the

available options can help in minimising transaction fees.

Complex Documentation: While there are documentation requirements, they are typically straightforward. Being aware of the necessary paperwork is crucial for a smooth transfer process.

Required Documents:

Identification: Valid identification documents, such

as passports, are essential.

Bank Account Details: Accurate and complete bank account

information, including the recipient's name, account number, and the bank's

SWIFT/BIC code.

Purpose of Transaction: Some transfers may require

documentation explaining the purpose, especially for more significant amounts.

Steps to Transfer Funds from

Australia to Singapore:

Select a Transfer Method: Choose between traditional banks,

money transfer services, or online platforms. Each has its advantages and

considerations.

Compare Exchange Rates: Exchange rates can vary among

providers. Comparing different rates ensures you acquire the best value for

your money.

Provide Correct Information: Double-check recipient details to

avoid errors leading to delays or failed transactions.

Choose Transfer Speed: Consider the urgency of the transfer

and select the appropriate speed option, keeping in mind that faster transfers

may incur higher fees.

Common Mistakes:

Ignoring Exchange Rates: Failing to monitor exchange rates

can result in significant differences in the amount received on the other end.

Neglecting Transfer Limits: Some platforms may restrict the amount you can transfer in a single transaction or within a specific time frame.

Dos and Don'ts:

Dos:

Do Compare Providers: Research different money transfer

options to find the most suitable one for your needs.

Do Confirm Fees and Conversion Rates: Ensure transparency by confirming

all fees and exchange rates before transferring.

Don'ts:

Don’t Overlook Security Measures: Opt for reputable, secure transfer

services to protect your financial information.

Don’t Rush Without Verification: Review all details before confirming the transfer to avoid mistakes.

Final Words

Sending money from Australia to Singapore is a necessity for the Singaporean community. By understanding the process, dispelling myths, and adhering to best practices, individuals can ensure a seamless and cost-effective transaction, fostering financial connectivity between these two nations.