No doubt! Putting your finances in the right direction should always be ahead of other priorities, laying a foundation for you to have a quality standard of living for both your family and you. Not long ago, financial management was only attributed to businesses’ financial matters, but it has evolved to the level of a person’s finances, manifesting its importance for every individual. Therefore, you should think of mastering the craft of financial management to have a hassle-free financial life both in the present and in the future.

What’s in This Most Practical Financial Guide?

- Keep Your Debts in Control

- Create Your Budget

- Get Your Budget on Track

- Investment in a Pension

- Create an Emergency Fund

- Focus on yourself and your family’s

Financial Protection

- Plan your Savings

- Set a Half-Yearly Budget for

Remittance Being an Expat

Keep Your Debts in Control

When

managing your financial obligations, prioritizing the repayment of debts

becomes crucial. If you find yourself juggling loans or carrying credit card

balances, a strategic approach involves tackling the debts with the highest

interest rates or those imposing late payment fees. This ensures that you are

minimizing the overall cost of your debt.

For instance, credit and store cards generally impose higher interest rates than

personal loans from traditional banks. By directing your efforts towards By clearing these high-interest debts, you significantly reduce the financial

burden they impose. While Buy Now, Pay Later (BNPL) arrangements may not accrue

interest, it's vital to exercise caution regarding potential fees associated with with late payments.

Vigilance in

such agreements is paramount, as violating these terms can lead to penalties or

additional interest charges. Maintaining a clear understanding of the

contractual obligations ensures a smoother financial journey and avoids

unnecessary financial setbacks.

It's It is important to note that even when prioritizing the repayment of a specific debt,

you should not neglect the minimum payment requirements on credit cards and the

monthly stipulated payments on loan agreements. Meeting these baseline

obligations safeguards your financial standing and prevents any adverse

consequences that may arise from non-compliance.

In summary, a meticulous approach to debt repayment involves thoughtful consideration of interest rates, late payment fees, and adherence to contractual terms. By navigating these aspects judiciously, you can work towards financial freedom and ensure a more stable economic future.

Create Your Budget

Upon identifying any outstanding debts that need attention, the pivotal next stride toward financial empowerment involves the establishment of a meticulously crafted budget. While this may demand a modest investment of time and energy, it is an invaluable tool for obtaining a swift overview of your financial inflows and outflows.

Kicking off a budgeting journey requires systematically evaluating the following expenditure categories.

Household Bills: Scrutinize and quantify the

essential expenses associated with maintaining your residence, encompassing

utilities, rent or mortgage payments, and other indispensable costs related to

domestic upkeep.

Living Costs: Delve into the day-to-day expenditures

integral to your lifestyle, encompassing groceries, clothing, and miscellaneous

personal expenses that contribute to your standard of living.

Financial Products: Assess the financial tools and services you utilize, including insurance premiums, bank charges, and interest payments on loans or credit cards, to comprehend their impact on your budgetary landscape.

Family and Friends: Explore the financial commitments

arising from your relationships, be it in the form of gifts, contributions to

special events like weddings, or other familial and social obligations.

Travel Expenses: Evaluate the costs associated with

your mobility, ranging from public transportation expenses to car-related

outlays such as fuel expenditures and mandatory MOT tests.

Leisure Activities: Scrutinize the financial facets of

your leisure pursuits, encompassing holidays, gym memberships, dining out, and

other forms of entertainment.

As you meticulously dissect each component, you pave the way for a comprehensive understanding of your financial dynamics. This knowledge facilitates the cultivation of sensible spending habits and positions you to make informed decisions that align with your long-term financial goals.

Get Your Budget on Track

If you find

yourself exceeding your income, it's crucial to scrutinize your expenditures.

Exploring avenues for potential savings can be instrumental in regaining

financial stability.

Consider maintaining a spending diary, diligently recording every purchase made throughout the month. Alternatively, if your financial transactions primarily involve credit or debit cards, scrutinize the previous month's statement to discern and evaluate your spending patterns.

Budget creation is multifaceted, and

various approaches can be tailored to individual preferences. Here are several

suggestions:

· Utilize our user-friendly Budget Planner—an accessible and complimentary tool that enables you to save your information for future reference, offering the flexibility to revisit and revise your budget at your convenience.

· Establish a budget using a spreadsheet or opt for the traditional method of recording expenses on paper. This hands-on approach can provide a tangible and tactile connection to your financial planning.

· Leverage the convenience of technology by exploring free budgeting apps. These digital solutions offer a streamlined and efficient means of managing your finances, making the budgeting process more accessible and interactive.

·

Investigate

whether your bank or building society provides an online budgeting tool that

seamlessly extracts information directly from your transactions. This

integrated approach can offer real-time insights into your financial habits,

aiding in more informed budgeting decisions.

Finding a budgeting plan that aligns with your preferences and lifestyle is critical. By adopting a proactive approach and leveraging available tools, you can gain better control over your finances and work towards achieving your financial goals.

Investment in a Pension

Understanding

that a pension is a long-term investment to provide future income is crucial.

The amount you contribute now directly impacts the financial security you'll

enjoy after retirement. It's essential to balance your current financial needs

and those anticipated. A prudent approach is to consider any decision to reduce

your pension savings presently, as it may lead to regret when you cease

working.

Remember

that your employer also contributes if you are enrolled in a workplace pension.

Overlooking this employer contribution means missing additional funds that

could significantly bolster your retirement savings. Furthermore, each

contribution you make to your pension attracts government benefits. Therefore,

reducing your contributions may result in a diminished top-up from the

government. Maximizing your contributions to ensure optimal financial support

in the long run is in your best interest.

Notably,

your pension represents one of the most tax-efficient means of saving for

retirement. The government automatically provides a 20% relief on pension

contributions for most individuals classified as basic-rate taxpayers. This tax

relief enhances the attractiveness of pension savings as a wise and financially

savvy choice for securing your retirement future.

Consider these factors carefully as you navigate your pension planning, recognizing the interconnectedness of present decisions and their impact on your financial well-being in the years to come.

Create The Emergency Fund

Accumulating

emergency savings is a prudent strategy to safeguard against unforeseen

expenses, particularly in unexpected mishaps like a malfunctioning washing

machine or boiler breakdown. It is advisable to target a minimum of three

months' worth of essential expenditures and maintain these funds in an easily

accessible savings account for immediate use.

In times of

unexpected financial challenges, having a robust emergency fund provides a

valuable cushion, offering financial security and peace of mind. Individuals

can fortify their economic resilience and swiftly address unforeseen

circumstances without undue stress by diligently setting aside funds equivalent

to three months' essential outgoings.

Choosing an instant-access

savings account for this purpose ensures liquidity and convenience. This

approach enables quick and hassle-free access to emergency funds when needed,

facilitating a prompt response to unexpected financial demands. Accessing these

funds instantly can make a significant difference in effectively managing and

overcoming unanticipated financial hurdles.

Maintaining a well-funded emergency savings account is a proactive financial strategy, empowering individuals to navigate life's uncertainties with confidence and economic stability. It provides a tangible safety net, allowing for a more resilient and adaptable approach to the inevitable surprises that life may throw.

Focus on yourself and your family’s

Financial Protection.

Once Your

emergency savings fund is securely established, it's time to safeguard your

income against unforeseen challenges proactively. Deliberate the various

insurance options available to shield your income, health, mortgage, loan

obligations, or those dependent on you.

The critical

task is to discern the precise protection you require and meticulously assess

the associated risks and benefits vis-à-vis the costs and coverage. The

responsibility lies with you to prioritize what matters most and strategize how

to fortify it.

Initiate

this process by setting a clear goal for yourself. Identify the paramount

aspects of your life that necessitate protection, be it securing your

children's financial future, ensuring the stability of your mortgage payments,

or safeguarding your income.

Following

this, conduct an audit of your existing protection measures. If you are

employed, your benefits package may already include life insurance or a

temporary income protection plan in the event of incapacity due to illness or

injury.

Subsequently,

evaluate the additional protection insurance you may require, considering the

existing coverage and the specific entities or aspects you intend to safeguard.

For an in-depth exploration of insurance options, refer to our comprehensive Insurance section. It guides you through the diverse types of coverage available and aids in selecting the optimal policy tailored to your needs. Making these informed decisions can pave the way for a more secure and resilient financial future.

Plan Your Savings Properly

Allocating funds for savings may seem challenging, but establishing a habit of contributing to a savings account every month is a prudent approach. This financial strategy provides a safety net for unforeseen circumstances and facilitates the achievement of various savings objectives.

Consider the following potential savings goals:

Homeownership: Saving for a deposit to purchase a

home is a substantial and common objective. It signifies a significant step

towards securing a stable living environment and building equity. Our

comprehensive guide on saving for a home deposit can offer valuable insights

into this process.

Car Purchase without Loans: Buying a car without resorting to loans is a commendable goal. To delve deeper into practical strategies for saving money for a vehicle, explore our dedicated guide tailored to assist you.

Stress-free Holidays: Planning a holiday without the

looming concern of post-trip bills is an attainable aspiration. Our guide on

saving money for a holiday is designed to provide practical tips and advice for

ensuring a relaxing vacation experience.

Retirement Planning: Channeling efforts toward saving more

for retirement is a wise decision. Our detailed guide on why one should save

into a pension sheds light on the long-term benefits and considerations

associated with retirement planning.

Financial Support during Family

Leave: Anticipating

and preparing for financial needs during maternity, paternity, or adoption

leave is a responsible use of savings. Having a financial cushion ensures a

smoother transition during these crucial life moments.

As your

savings portfolio grows, contemplation on investment opportunities becomes

pertinent to meet long-term financial goals. Investing a portion of your

savings, especially if you are willing to commit funds for an extended period,

has the potential to yield a more substantial return.

Explore our dedicated section on Savings for insightful tips and guidance on effective saving strategies. We aim to empower you with the knowledge and tools to navigate the path to financial security and success.

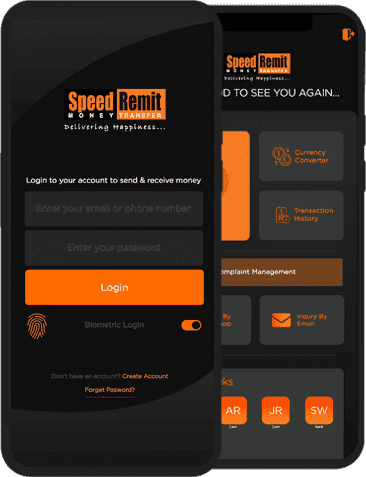

Set a Half-Yearly Budget for

Remittance Being an Expat

True,

setting your remittance budget is also a crucial factor of financial

management, particularly for expatriates. Honestly, come out of the conventional

way of sending remittances by just sending a random amount every month because

that somehow affects your financial planning. Therefore, it is ideal to set a

half-yearly remittance budget, if not for a year; it helps to keep your

financial plans going steadily. Furthermore, the most reliable platform for

sending money is none other than Speed Remit, which has the following features:

Two Initial Transfers Free

Experience

the convenience of sending money without any charges for your first two

transactions. At Speed Remit, we believe in providing a seamless and

cost-effective way for you to kickstart your money transfers.

Competitive Exchange Rates

Enjoy

competitive exchange rates that ensure your loved ones receive the maximum

value for the money you send. At Speed Remit, we strive to offer rates exceeding

your expectations.

Swift and Secure Transactions

Trust in the

speed and security of your transactions with Speed Remit. Our robust systems

ensure your money reaches its destination promptly while maintaining the

highest security standards.

Global Network of Partners

With an

extensive network of trusted partners worldwide, Speed Remit ensures that your

money can be sent and received conveniently across borders. We are committed to

making your global transactions hassle-free.

User-Friendly Interface

Our

intuitive and user-friendly platform makes the process of sending money a

breeze. Whether you're tech-savvy or a first-time user, Speed Remit is designed

to cater to all levels of users.

24/7 Customer Support

Experience

unparalleled customer support around the clock. Our dedicated team is ready to

assist you with any queries or concerns, ensuring a smooth and pleasant

experience every time you use Speed Remit.

Transparent Fee Structure

At Speed

Remit, transparency is critical. Our straightforward fee structure ensures you

know the costs of your transactions upfront, without any hidden fees.

Advanced Security Measures

Stay

confident that your financial details are safeguarded with highly encrypted security

measures. Speed Remit prioritizes protecting your data, employing cutting-edge

technology to maintain the highest levels of security.

Real-Time Tracking

Stay informed about the status of your transactions with our real-time tracking feature. Speed Remit updates at every step, offering peace of mind as your money travels across borders.

Frequent Promotions and Loyalty

Rewards

Benefit from

our regular promotions and loyalty rewards programs, making your experience

with Speed Remit efficient and financially rewarding.

Choose Speed Remit for your money transfer needs – where speed, reliability, and customer

satisfaction converge for an unparalleled financial experience.