Sending

money from Australia to India is necessary for many individuals, whether for

family support, investments, or other financial commitments. Finding reliable

and efficient methods for international money transfers is crucial in our

globalized world.

Suppose

you're looking to send money to India from Australia. In that case, this guide

will provide valuable insights into the various methods available, along with

essential tips, debunking myths, and outlining dos and don'ts to ensure a

smooth and secure transaction process.

Methods to Send Money to India from Australia:

Bank Transfers: Traditional and widely used bank

transfers involve sending money directly from your Australian bank account to

the recipient's Indian bank account.

Online Money Transfer Platforms: Utilize reliable online money

transfer platforms for instant and easy transactions and Speed Remit really

Cash Transfer Services: Many services allow for cash pickups

in India and provide flexibility for recipients without bank accounts, so going

with the one offering more customized services is a great idea.

International Wire Transfers: Facilitated through banks, wire

transfers enable you to send large sums securely, though they may involve

higher fees.

Sending money from Australia to India involves various considerations, and people may need help. Here are a few common errors to be mindful of:

· Ignoring Exchange Rates:

Mistake: Failing to check and compare

exchange rates.

Solution: Research current rates and choose a competitive provider to maximize the amount received in India.

· Overlooking Transfer Fees:

Mistake: Not considering the fees associated

with the transfer.

Solution: Be aware of transfer fees, and opt

for providers with transparent fee structures or zero fees for specific

amounts.

· Choosing the Wrong Transfer Method:

Mistake: Selecting an inappropriate transfer

method.

Solution: Understand the pros and cons of

options like bank transfers, online platforms, or specialized remittance

services to select the most cost-effective and convenient method.

· Incomplete Documentation:

Mistake: Neglecting to provide accurate and

complete information.

Solution: Double-check all recipient details,

including bank account numbers and names, to ensure a smooth and error-free

transfer.

· Ignoring Transfer Time:

Mistake: Assuming all transfers have the same

processing time.

Solution: Consider the urgency of the transfer and choose a method that aligns with the desired speed of delivery.

· Not Considering Currency

Fluctuations:

Mistake: Disregarding the impact of currency

fluctuations.

Solution: Stay informed about currency trends and consider using tools like forward contracts or limit orders to manage risks associated with exchange rate volatility.

Using Unsecured Platforms:

Mistake: Using unsecured or unfamiliar

platforms.

Solution: Choose reputable and secure money transfer services to safeguard personal and financial information.

· Ignoring Customer Reviews:

Mistake: Not researching customer reviews and

feedback.

Solution: Review reviews and testimonials to gauge the chosen money transfer service's reliability and customer satisfaction.

· Forgetting Regulatory Compliance:

Mistake: Neglecting to ensure compliance with

regulatory requirements.

Solution: Verify that the chosen service complies with all relevant regulations to avoid legal issues and ensure a legitimate and secure transaction.

· Not Shopping Around:

Mistake: Settling for the first option

without exploring alternatives.

Solution: Compare different providers to find the most cost-effective and reliable option for your transfer needs.

Tips for a Successful Money Transfer:

· Exchange Rates Awareness: Stay informed about exchange rates

to maximize the value of your transfer.

· Choose the Right Service: Select a reputable, secure money

transfer service that meets your needs.

· Verify Recipient Details: Double-check recipient details to

avoid potential errors and delays.

· Consider Transfer Speed: Evaluate the urgency of the transfer

and choose a method that meets your timeline.

· Understand Fees: Know all fees, including exchange

rates and service charges.

Myths Debunked:

· Transfers Are Always Instant: Not all methods offer instant

transfers; it depends on the service chosen.

· Cryptocurrency is Untraceable: Cryptocurrency transactions are

traceable, though they provide a level of privacy.

· Banks Are Always the Best Option: While banks are secure, alternative

platforms may offer better rates and faster transfers.

· Low Fees Mean Better Value: Evaluate the overall cost,

considering exchange rates and additional charges.

· All Services Are Equally Reliable: Research and choose a service with a

solid reputation and positive user reviews.

Dos and Don'ts:

Dos:

· Do Compare Services: Research and compare transfer

services for the best rates.

· Do Check Reviews: Read user reviews to ensure the

reliability of the chosen service.

· Do Keep Transaction Records: Maintain records for future

reference and dispute resolution.

· Do Confirm Exchange Rates: Confirm the current exchange rates

before transferring.

· Do Stay Informed: Stay updated on regulations and changes in the money transfer landscape.

Don'ts:

Don't Share Sensitive Information: Avoid sharing unnecessary personal information to protect against fraud.

Refrain from ignoring Fees: Understand all fees involved to

avoid unexpected costs.

Don't Rely Solely on Exchange Rates: Consider the overall cost of the

transfer, not just favorable exchange rates.

Don't Rush the Process: Take your time to ensure accurate

details and a smooth transaction.

Don't Overlook Customer Support: Choose a service with reliable

customer support for assistance if needed.

A Profound Insight of Growing Indian Expats in Australia

While

gauging the Census in Australia 2021, you notice the Indians to be the second-largest immigrants

in Australia, and that massive boom took place between 2016 and 2021. This

research draws your attention to the enormous fund transfers to India in the

mentioned period and a possible future surge of money transfers in the upcoming

years. The Australian Government’s vision for the payment system indicates its devotion to improving

the remittance landscape in the country.

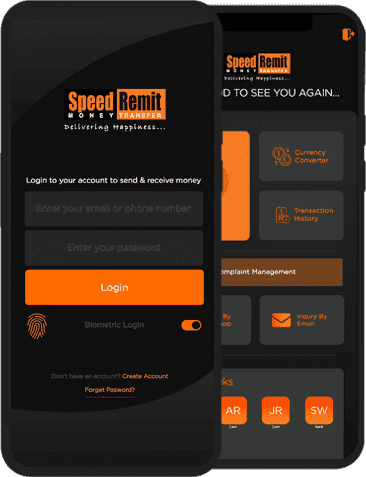

What Makes Speed Remit Stand Apart

Speed Remit

stands out as the high point of reliability and efficiency regarding money

transfers from Australia. As a leading platform in the financial landscape, Speed

Remit has earned a remarkable reputation for its hassle-free and secure transfer

services. Operating to provide a hassle-free experience, Speed Remit ensures

that funds are delivered instantly and safely to recipients. The platform

boasts cutting-edge technology, ensuring that transactions are rapid and

secure, giving users peace of mind in their financial dealings. With a

user-friendly interface and transparent fee structures, Speed Remit eliminates

the complexities often associated with international money transfers, making it

the go-to choice for individuals seeking a reliable means to send money from

Australia. Speed Remit's dedication to customer satisfaction is evident through

its responsive customer support team, ready to assist with any inquiries or

concerns. In a world where financial transactions demand trust and efficiency,

Speed Remit is a beacon of reliability, setting the standard for excellence in

international money transfers from Australia.

Wind Up