Sending money across borders, especially from Australia to Thailand, requires

meticulous planning to guarantee a seamless and successful transaction. This

comprehensive guide aims to assist you in navigating the intricate process of

international money transfers, providing valuable insights into available

methods and considerations to make your financial transactions hassle-free and

secure. Understanding the various transfer options is crucial in making an

informed decision.

From traditional bank wire transfers to online platforms and specialized remittance services, each method has its advantages and considerations. We will explore these options in detail, highlighting their features, fees, and processing times. Factors such as exchange rates and potential hidden charges can significantly impact the overall cost of your international money transfer.

Remittance Factors This Guide Sheds Light On

This guide

will explain how to get the best exchange rates and minimize fees, ensuring you

maximize the value of your transferred funds. Security is paramount when

transferring money internationally. We will investigate the safety measures of

different transfer methods, including encryption, fraud protection, and

regulatory compliance. Understanding these security features is essential for

safeguarding financial transactions and personal information. Furthermore, we

will discuss the documentation required for international money transfers, such

as identification documents and recipient details.

Being well-prepared with the necessary paperwork will expedite the transfer process and reduce the likelihood of any delays. Navigating the complex landscape of international money transfers demands careful consideration and thorough knowledge. This comprehensive guide will equip you with the information to make well-informed decisions, ensuring a smooth and successful financial transaction from Australia to Thailand.

Get Acquainted with Available

Methods:

1. Bank Transfers:

Conduct bank

transfers online or in person at your bank.

Explore

specialized international money transfer services financial institutions

provide, such as wire transfers or remittance services.

2. Comparison and Selection:

Compare

fees, processing times, and exchange rates of different methods.

Select the method that aligns with your needs & requirements.

Significant Steps for a Successful

Transfer:

A. Providing Accurate Information:

·

Furnish

complete details about the sender and recipient, including full names,

addresses, and banking information.

·

Double-check

all provided information to avoid delays.

B. Considering Exchange Rates:

·

Be

mindful of exchange rates as they impact the final amount received by the

recipient.

·

Explore

providers offering favourable rates to maximize the value of your transfer.

C. Avoiding Common Mistakes:

·

Review

and confirm all information before initiating the transfer.

·

Common

errors to avoid include providing incorrect recipient details or neglecting

applicable fees.

D. Compliance with Regulations:

·

Prepare

necessary documents for sender and receiver, including proof of identification

and address.

· Compliance with international regulations may require additional documentation.

Steps to Transfer Money from

Australia to Thailand:

Select a Reliable Money Transfer Service:

· Research

and select a reputable service, considering banks, online platforms, and

remittance providers.

Create an Account:

·

If

using an online platform, create an account by providing necessary personal

information and verifying your identity.

Select the Transfer Method:

·

You

can choose between bank transfers, online transfers, or cash pick-up services

based on speed, cost, and convenience.

Enter Recipient Details:

·

Provide

complete recipient details, including full name, contact information, and bank

account details if applicable.

Specify the Amount and Currency:

·

Clearly

state the amount and select the desired currency for the recipient.

Review and Confirm:

· Double-check all entered information, transaction fees, and exchange rates before confirming the transfer.

Money Transfer Methods:

1. Bank Transfers:

·

Direct

transfer from your Australian bank account to the recipient's in Thailand.

·

This

method may take a few business days to complete.

2. Online Money Transfer Platforms:

·

Utilize

platforms like Speed Remit, TransferWise, or PayPal for quick and secure

transfers.

·

Some

platforms offer competitive exchange rates and low transaction fees.

3. Cash Pick-up Services:

· Some providers offer cash pick-up options at designated locations in Thailand.

Avoiding Common Pitfalls:

Neglecting Exchange Rates:

·

Stay

mindful of exchange rates to ensure the recipient receives the maximum amount.

Ignoring Fees:

·

Understand

and factor in all fees associated with the transfer to avoid unexpected costs.

Providing Incorrect Information:

· Double-check recipient details to prevent delays or complications.

Required Documents for Sender and

Receiver:

Sender's Documents:

·

Valid

photo identification (passport, driver's license).

·

Address

verification: “utility bill, bank statement.”

Receiver's Documents:

·

Valid

photo identification.

·

Transaction

reference number.

·

In

a few cases, verification of address may be needed.

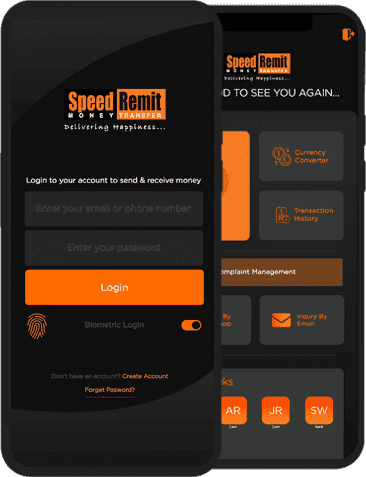

Why Choose Speed Remit?

Quick Transfers:

·

Rapid

and timely money transfers ensure funds reach your loved ones in Thailand.

Competitive Exchange Rates:

Enjoy favourable

rates, maximizing the recipient's value for the money sent.

Low Transaction Fees:

· Say

goodbye to excessive fees, as Speed Remit offers affordable transaction costs.

User-Friendly Interface:

·

Navigating

the platform is easy, ensuring a smooth and hassle-free transfer experience.

Top-notch Security:

·

Your

financial information is encrypted and protected, guaranteeing secure

transactions.

24/7 Customer Support:

· Dedicated customer support is available round the clock to address concerns and provide guidance.

Getting Started with Speed Remit:

Sign Up:

·

Create

an account on the Speed Remit platform for a quick start.

Verify Your Identity:

·

Complete

the identity verification process for added security.

Initiate Transfer:

·

Enter

recipient details, select the amount, and confirm the transaction for a

seamless transfer.

“Prefer Speed Remit over other remittance services to send money to Thailand from Australia as it addresses all your remittance-related worries. Experience speed, security, and reliability, bridging the distance with seamless money transfers. Trust Speed Remit to connect you with your loved ones, ensuring a worry-free financial exchange.”