What is The IPO in the Global Business

Arena?

Hey! Are you

scratching your head over the terminology called IPOs? IPOs are the term used

for companies selling their shares to widen their investor base globally, and

it not only helps them expand capital but also improves global visibility. Like

other sectors, the cross-border sphere also has a reasonable share of IPOs with

ups and downs over time, and this is what this write-up will unearth, helping

you to hunt possible ways of investment in this specific sphere.

Causes behind

Declined IPOs in 2023

With dozens of IPOs

declining in 2023, financial experts doubt whether 2024 will succeed in IPOs in

all sectors, including the cross-border money transfer sphere. While evaluating

further, you notice factors behind declined IPOs are an unbalanced economic

landscape, massive interest rates, growing inflation, and geopolitical issues.

After a significant

acceleration of IPOs in the early months of 2020, many companies have since repelled

taking initiatives for IPOs amid an unstable investment environment. Yes, this

shaky financial stability also jolted the remittance world as it didn’t

continue venturing into more public listings despite having massive IPOs in

2021.

Growth

Predictability of IPOs up to 2025

However, with the

central bank squeezing interest rates and companies generating sensible probabilities,

the IPOs tend to progress up to 2025. In this regard, the BNPL payments

provider Klana is all set to acquire consultancy services from central banks

such as Morgan Stanley, Goldman Sachs, and JPMorgan.

If IPOs sustain

their progressive journey in the remittance space, there will be an influx of

remittance companies towards IPOs such as Remitly, Flywire, Wise, Payoneer, and

dlocal.

Remittance Companies Listed

Publicly in Recent Years

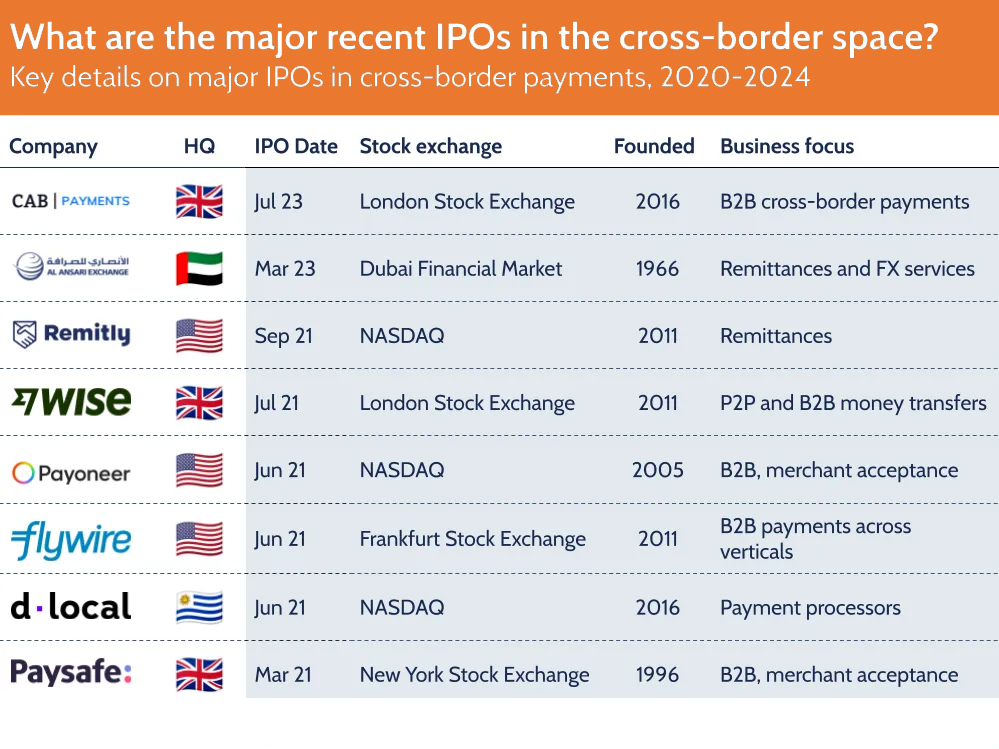

The year 2021

witnessed massive companies’ IPO activities at a similar time with different

focuses. For instance, Wise & Remitly was determined on consumer money transfers

and remittances. Payoneer, with the mission of going public via a SPAC deal,

was determined for cross-border e-commerce. The Flywire handled cross-border

payments in education, B2B healthcare, and travel niches, and IPOs are heading

in the right direction.

Then, the

cross-border payment landscape is about to witness many other newly emerged

remittance companies adapting to IPO growth strategies. Actual remittance

companies that opted for IPO were not only for massive cash injection but also

for getting more global exposure. For example, Wise joined The London Stock

Exchange through straight listing without hunting for capital, which accomplished

the company’s goal of going international.

Analysis of Remittance IPOs from

2020 to 2024

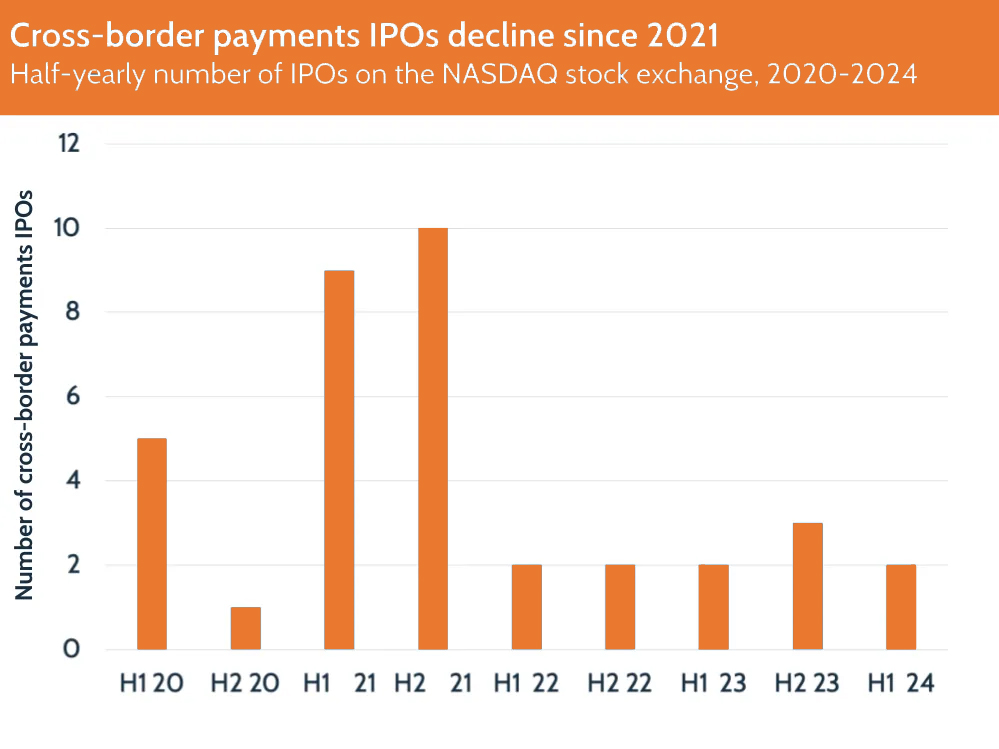

From the beginning

of 2020 to June 2024, 5,200 IPOs were listed on Crunchbase across every sector,

with just over 100 of them linked to payments. More than 30 companies either

focused on cross-border payments or made it an essential part of their

offering, specifically manifesting cross-border payments on their sites.

Several cross-border payment IPOs have been on a downward spiral since 2021 but

have remained stable on a half-yearly basis for the last two years.

High Employee Numbers of Cross-Border IPO Companies

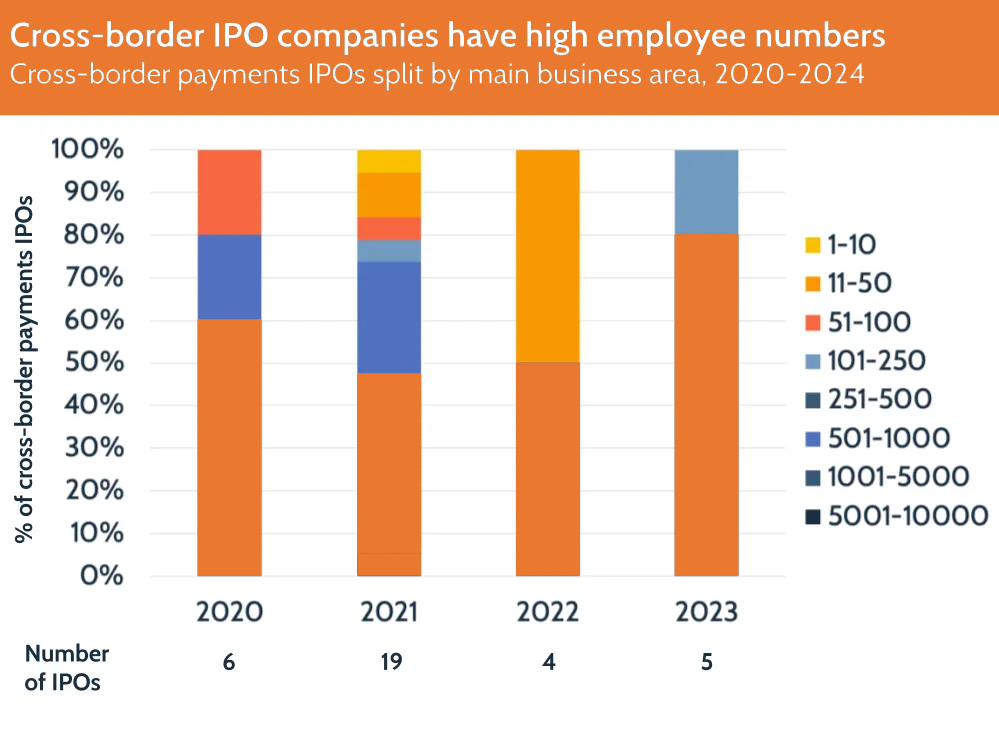

While evaluating

cross-border payment IPOs from the perspective of a higher number of employees

by the companies involved in IPOs, you witness a massive number ranging from

101-250 to 5000-10,000 employees. Interestingly, more than half of the

companies already had over 10,000 workers when they started their IPO journey.

While digging more, you also explore how companies with smaller numbers dived

into the sea of IPOs such as AppTech.

Furthermore, most

companies that opted for IPO business strategy are based in the USA, followed

by the UK & India, and some remittance companies went to get listed on

stock exchanges outside of where they are situated. For instance, UK-based cross-border company Paysafe was

listed on the New York Stock Exchange, and according to financial experts,

listing abroad helps a company’s expansion strategy by attracting new customers

in new markets.

Companies that Can Announce IPO in the Future

Having witnessed the

positive outcomes of venturing into IPOs, companies are gearing up to get into

it; thus, the remittance world will witness lots of IPO activities, benefiting

this particular sphere from a larger perspective. In this journey of IPO

venturing by remittance companies, you witness Revolut being very passionate,

and its recent report of 2023 reveals the company’s revenue of 95% worth £1.8bn.

The company is determined to align its financial processes with those of the

publicly listed companies.

Similarly, the CEO

& Co-Founder of Rapyd Arik Shitlman told TechCrunch that B2B payment

providers were gauging factors like market conditions, potential funding, and

investor motivation when going public. Furthermore, Stripe's recent drive to

grow profit has dampened the need to opt for an IPO, emphasized by the

company’s CEO & president John Collison's statement of “no rushing to go

public” to Financial Times.

Wrapping It Up

Yes! Extra cash

injection through IPO helps companies pay off their debts; for instance, Nuvei

aimed to ensure its return on its M&A practice by rewarding its workers

with great stock options. While IPO paves the way for companies to go public

and raise funds, hurdles such as strict cost regulation, the requirement of manifesting

quarterly profits to invests, and the enhanced public scrutiny are dampening

companies’ move to integrate into IPO business strategy, and that needs to be

catered for the IPO-led cross-border payment companies on a larger scale in

upcoming years.

The massive IPO activities in the forthcoming years, particularly in the remittance landscape, will encourage ordinary people more to invest safely in remittance companies they use to transfer funds. Furthermore, when sending money to Pakistan, India, Bangladesh, Nepal, and the Philippines from Australia or Singapore, you should consider Speed Remit the most reliable and encrypted option to transfer funds.